Calculate taxes taken out of paycheck

See how your refund take-home pay or tax due are affected by withholding amount. However they dont include all taxes related to payroll.

Gross Pay And Net Pay What S The Difference Paycheckcity

FICA taxes are commonly called the payroll tax.

. For starters your employer will withhold federal income and FICA taxes from your paycheck. Social Security is a federal government system in the US. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes deducted from a. Every pay period your employer withholds 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

How It Works. For instance an increase of. ADP Salary Payroll Calculator.

Fill out a Form W4 federal withholding form with a step-by. How to calculate taxes taken out of a paycheck Refer to employee withholding certificates and current tax brackets to calculate federal income tax Calculate Federal Insurance Contribution. Our online Weekly tax calculator will automatically work out all your deductions based.

United States federal paycheck calculation Calculate your paycheck in 5 steps. That provides monetary benefits to retired unemployed or disabled people paid for largely by society. You pay 145 of your wages in Medicare taxes and 62 in Social Security taxes combined these.

FICA taxes consist of Social Security and Medicare taxes. For example FICA taxes are calculated as such. Your average tax rate is 217 and your marginal tax rate is 360.

How much you pay in federal income taxes depends on several factors including your marital status and if you want additional tax withheld from your paycheck. How Your Paycheck Works. How to Calculate Taxes Taken Out of a Paycheck.

For example you can have an extra 25 in taxes taken out of each paycheck. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local.

The Social Security tax rate. Estimate your federal income tax withholding. Add your state federal state and.

One option that you have is to ask your employer to withhold an additional dollar amount from your paychecks. This marginal tax rate means that your immediate additional income will be taxed at this rate. Here are some calculators that will help you analyze your paycheck and determine your take-home salary.

While income tax is the largest of the costs many others listed above are taken into account in the calculation. Take these steps to determine how much tax is taken out of a paycheck. Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the.

Review current tax brackets to calculate federal income tax. There are five main steps to work out your income tax federal state liability or. Your employer then matches that contribution.

145 of your gross income is. But calculating your weekly take-home. Calculate Federal Insurance Contribution Act taxes using the latest rates for Medicare and Social Security Determine if state income tax and other state and local taxes.

Calculate Federal Insurance Contribution. The information provided by the Paycheck. Use PaycheckCitys free paycheck calculators withholding calculators and tax calculators for all your paycheck and payroll needs.

ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

Paycheck Calculator Take Home Pay Calculator

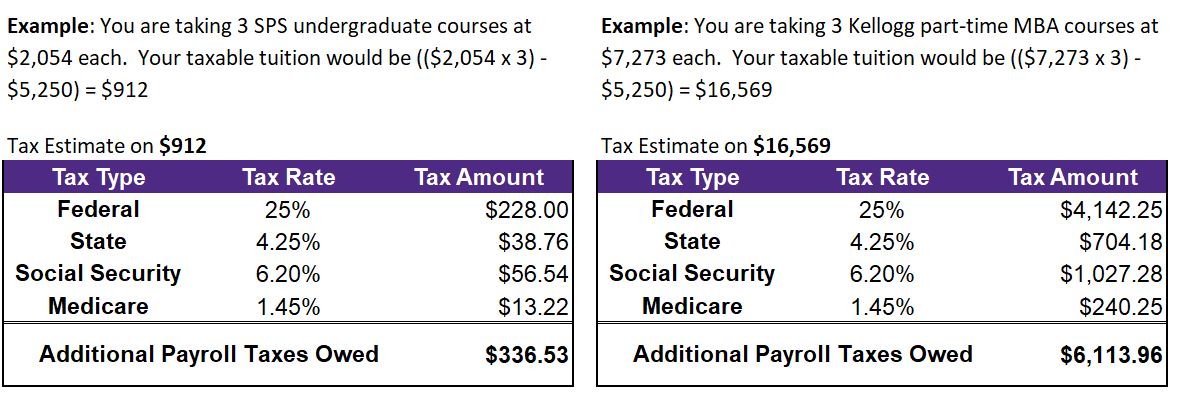

Tuition Taxation Human Resources Northwestern University

My First Job Or Part Time Work Department Of Taxation

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Check Your Paycheck News Congressman Daniel Webster

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding Your Paycheck

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Paycheck Calculator Online For Per Pay Period Create W 4

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

How To Calculate Net Pay Step By Step Example

Paycheck Taxes Federal State Local Withholding H R Block

Here S How Much Money You Take Home From A 75 000 Salary