Depreciation interest calculator

Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. After two years your cars value.

Tax Shield Formula Step By Step Calculation With Examples

You can choose any technique ie straight line declining.

. How to use the depreciation calculator Depreciation method - Choose which depreciation method to use. Our car depreciation calculator uses the following values source. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of.

After a year your cars value decreases to 81 of the initial value. There are two options here. It is the most common and simplest means of calculating depreciation.

D i C R i Where Di is the depreciation in year i C is the original purchase price or. It is an effective way to evenly distribute the cost over the beneficial life of the asset. A part of the payment covers the interest due on the loan and the remainder of the payment goes toward reducing the principal amount owed.

Just enter the loan amount interest rate loan duration and start date into the Excel. 100 10 10 This interest is added to the principal and the sum becomes Dereks required repayment to the bank one year later. The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices.

The formula is expressed as. A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the. So it helps the accounting software to exactly calculate the yearly depreciation of different assets as different rates are fitted for different assets.

100 10 110 Derek. Lets take an asset which is worth 10000 and. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

Straight Line Depreciation Cost of Asset Scrap ValueUseful life. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

Depreciation Amount Asset Value x Annual Percentage Balance. First one can choose the straight line method of. MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula.

It provides a couple different methods of depreciation. For more information about or to do. Use this calculator to calculate an accelerated depreciation of an asset for a specified period.

Straight line depreciation and sum-of-years-digits. Dn rate of different assets is different. This depreciation calculator is for calculating the depreciation schedule of an asset.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and.

A calculator to quickly and easily determine the appreciation or depreciation of an asset. Straight Line Depreciation Rate Straight Line DepreciationCost of Asset x 100 The underlying assumption of this. Straight Line Depreciation Calculator When the value of an asset drops at a set rate over time it is known as straight line depreciation.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. To use a depreciation calculator you need to determine which method you want to calculate the depreciated amount for you. Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel.

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Compound Interest Youtube

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Calculator Definition Formula

Calculator Tricks For Compound Interest And Depreciation Youtube

Compound Interest And Depreciation Youtube

Compound Interest And Reducing Balance Calculator Vce Geogebra

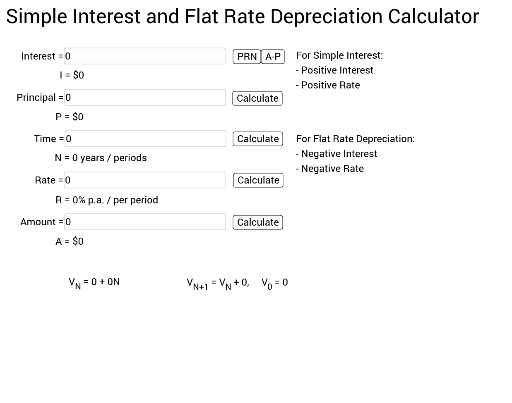

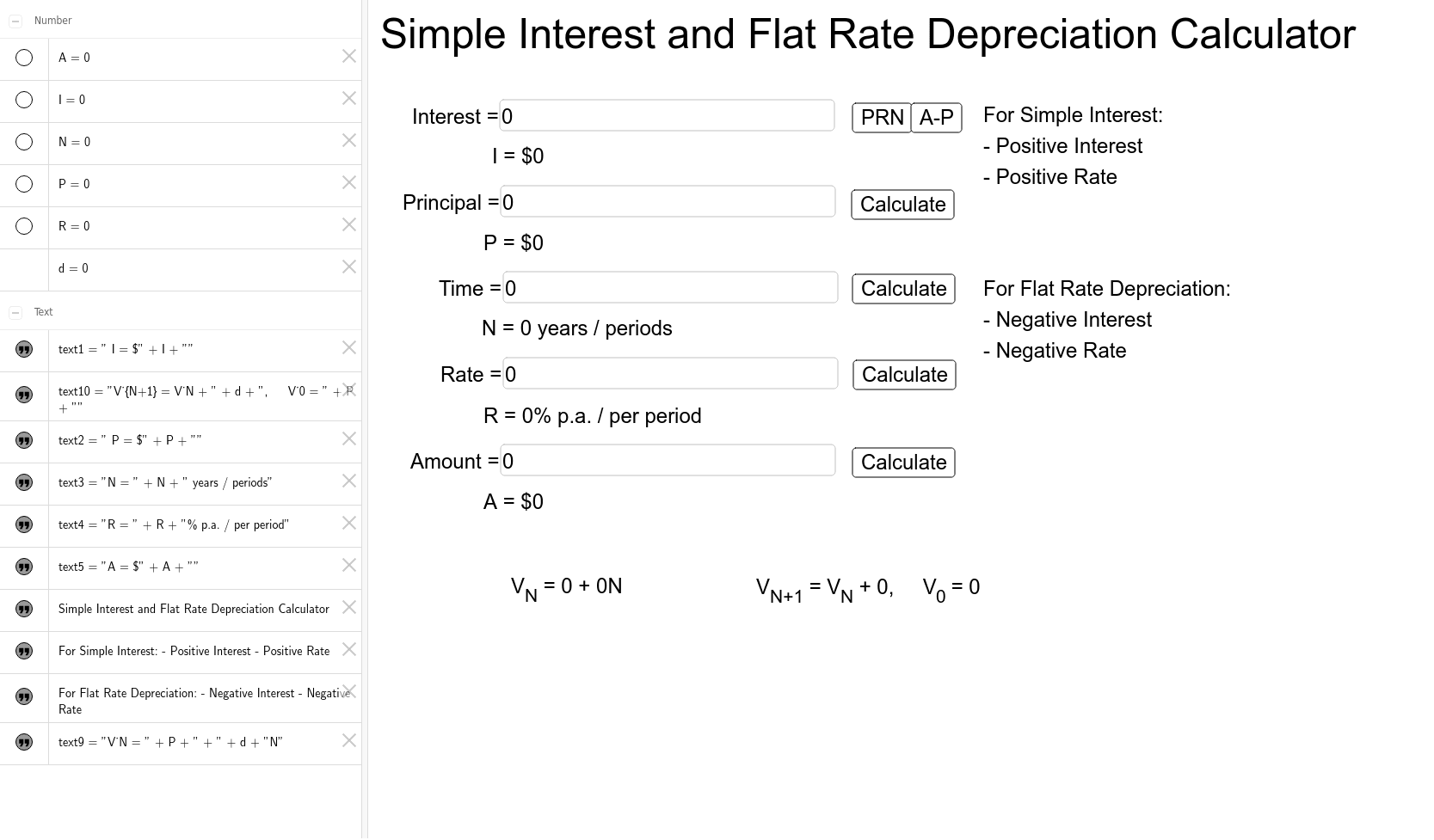

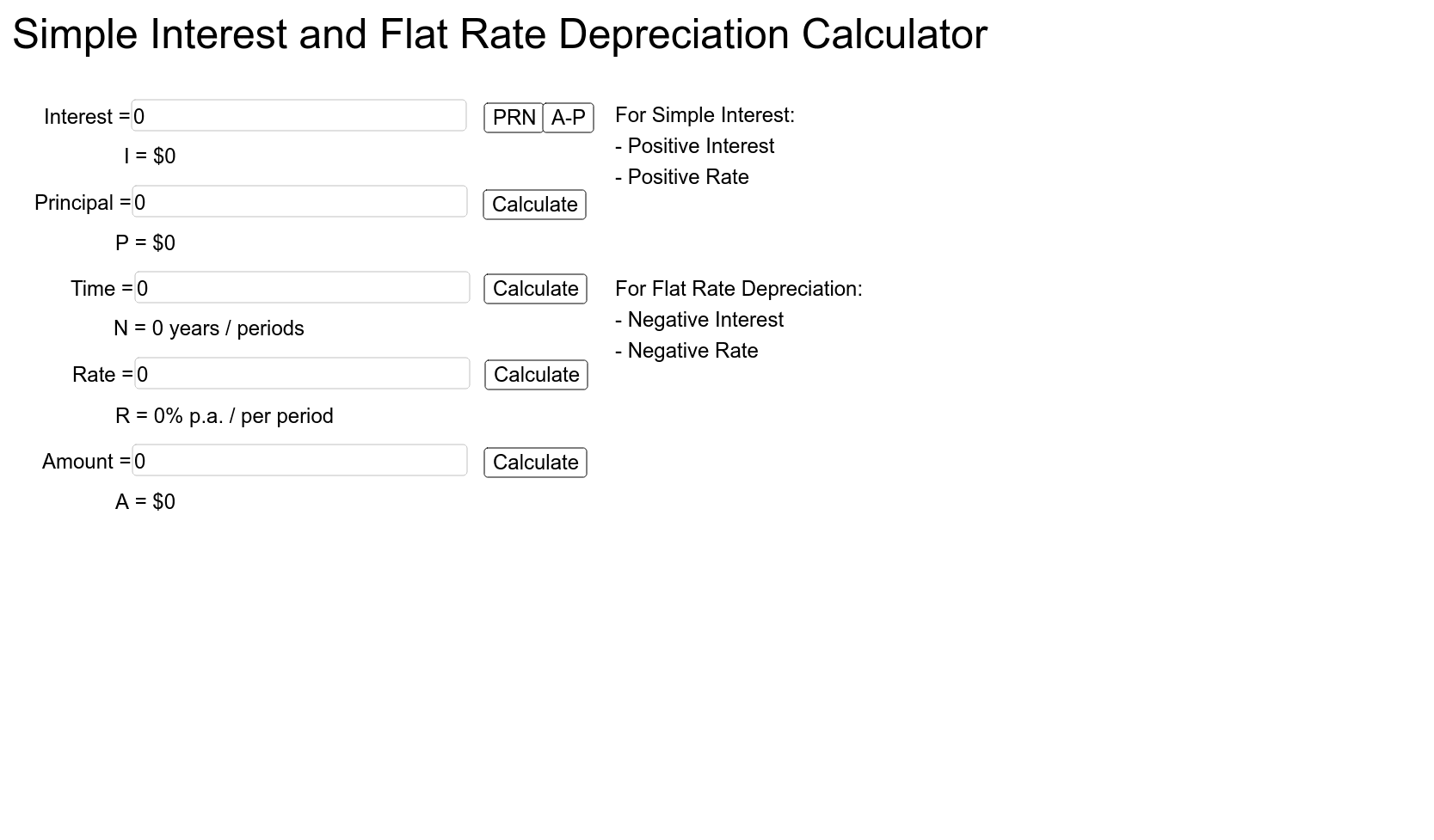

Simple Interest And Flat Rate Depreciation Calculator Vce Geogebra

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Free Macrs Depreciation Calculator For Excel

Compound Interest Calculator Daily Monthly Yearly

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Examples With Excel Template

Simple Interest And Flat Rate Depreciation Calculator Vce Geogebra

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Depreciation Calculator Property Car Nerd Counter